- #Business expense tracker free manual#

- #Business expense tracker free software#

Ramp is a business credit card and spend management platform aimed at helping small businesses streamline automation and reduce business spending. Let’s take a look at the seven best solutions to help your business simplify expense management. 7 best expense trackers for small businesses The key to choosing an expense tracker lies in evaluating organizational needs and how well an app can perform those tasks regularly. Overall, you’re looking for a solution that will help you easily claim tax deductions, file IRS returns, and manage company finances seamlessly.Ī good expense tracker is easy to use, tracks invoices, reimburses employees, keeps finance data ready for tax season, and is available on the go.

Scalability: consider how the vendor can help you meet future requirements.Įxpense management automation and app integration are a key consideration for small businesses. For example, if using a modern travel management tool-like TravelPerk-you want something that can integrate seamlessly to provide deeper travel spending insights. Integrations: assess if an app allows integration with third-party apps that you regularly use. Availability: check whether the app is available on Android, iOS, and desktop. User-friendly: evaluate how easily you can learn and use the app interface and functionalities. Here are the recommended features to look out for while choosing an expense tracking app: #Business expense tracker free software#

Today’s cutting-edge expense tracking software solutions come with various features, but what exactly should you be looking for? Small business expense tracking apps help business owners to reduce the paper trail, streamline expense entry, track tax deductions, and manage finances more efficiently. What to look for in a business expense tracker app for a small business? Not sure about the features that your expense tracker should have? We’ve compiled the essential business expense tracker features that come in handy as you grow.

Difficulties with regulation compliance: if you’re struggling with compliance, an expense tracking system can help you to simplify and cut through continuous compliance and risk complexity. If you’re spending more than a couple of hours every month verifying and reimbursing account payables, it’s time to upgrade. Delayed reimbursements: handling reimbursements manually reduces productivity and impacts employee satisfaction. Businesses unable to make informed decisions from existing finance management processes should consider adopting automated solutions. Inability to track financial data: this is another tell-tale sign that you might need expense tracking software. Businesses drowning in a sea of paperwork should automate expense tracking and management. Growing expenses: company expenses grow with the business-keeping on top of your expenditure is essential. Look for these signs and you’ll know it’s time to invest in an expense management solution. If you’re encountering any of these issues in your day-to-day business expenditure tracking, expense tracking apps might be a great option for you. #Business expense tracker free manual#

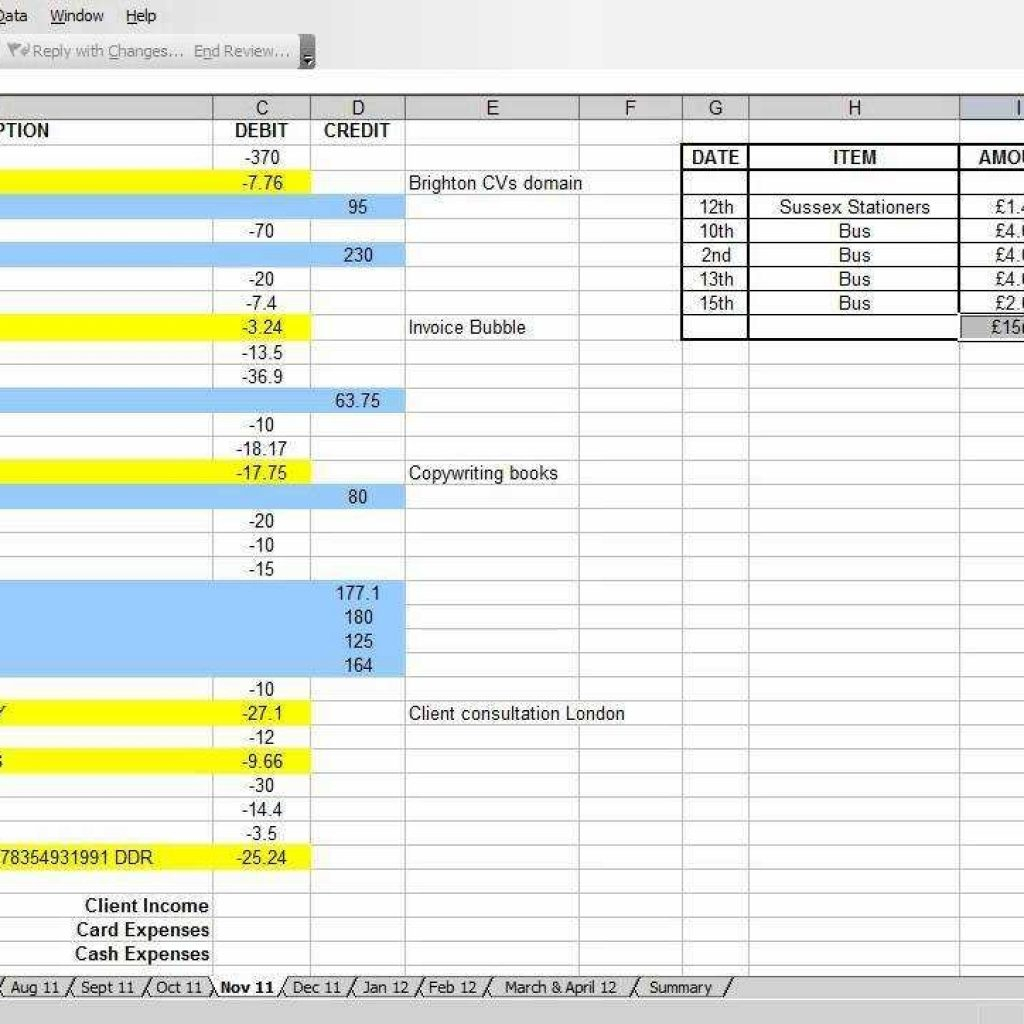

Plus, a lot of difficulties can pop up with excel sheets - such as data entry errors, limited automation options, and increased manual effort.

Managing expenses on paper or spreadsheets isn’t the wisest solution-especially if you’re looking to scale your team.

Does my company need expense tracker software? Users can add the business bank account, along with employees’ bank details, to speed up the expense management process. These apps ease the process of tracking incoming revenue sources, fixed costs, variable expenses, one-time purchases, and reimbursing employees.

Organizing due dates of incoming and outgoing payments. Scanning receipts and reimbursing employee expenses. Creating invoices and accepting payments. Small business expense tracker apps enable businesses to track and manage their expenses with an all-in-one solution. How do business expense tracker apps work? We’ll look at their unique features, the languages they support, and the pricing models on offer. Whether you’re a small business owner, running a 500+ corporate business or fall somewhere in between, this article will help you identify and evaluate the best small business expense tracking apps for you. These apps enable business owners and finance managers to track and manage expenses continuously for an accurate overview of business health. Small business expense tracking apps help businesses to track employee spending when away on business travel and streamline the entire expense management process. Expense tracking apps help both sides of the coin. Employees want to report expenses quickly and get reimbursed on time. Top 7 expense tracking apps for small businessesĮxpense tracking for small businesses can be tricky.Įmployers want to access up-to-date, financial records without the headache of going through piles of crumpled receipts or email chains.

0 kommentar(er)

0 kommentar(er)